Monthly Finance Plans for Families on a Budget

Monthly Finance Plans for Families on a Budget: Managing family finances on a limited budget can feel overwhelming, but with a well-structured monthly plan, you can cover essentials, save for the future, and even enjoy small luxuries—without financial stress.

Assess Your Income and Fixed Expenses

Before planning, know exactly how much money you have coming in and going out.

Steps:

-

List all income sources (salary, side jobs, benefits, pensions).

-

Note fixed expenses like rent/mortgage, utilities, insurance, and school fees.

-

Subtract fixed costs from your income to find your spendable amount.

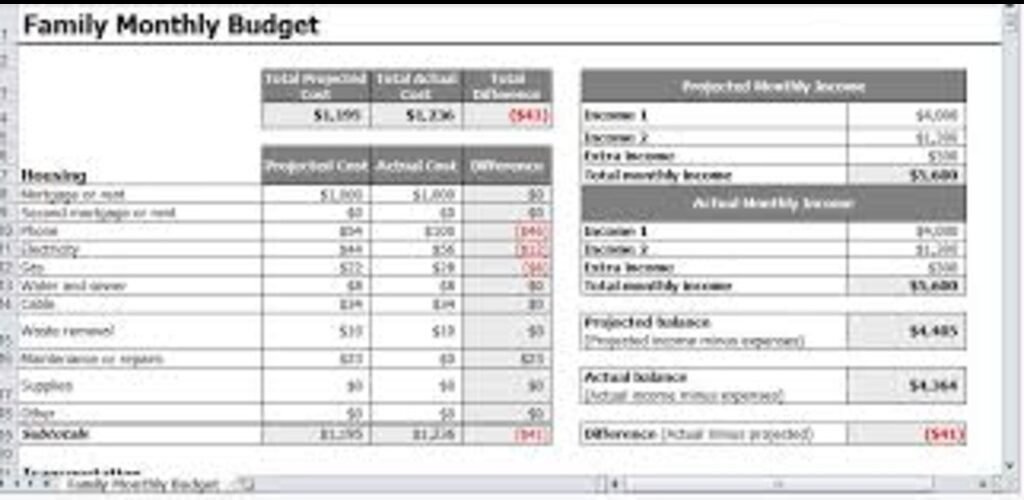

Tip: Use a budgeting app or a simple spreadsheet to track this each month.

Prioritize Needs Over Wants

Families often overspend on non-essentials without realizing it.

Focus on:

-

Groceries & household supplies

-

Utility bills

-

Education costs

-

Healthcare & insurance

-

Transport

Cut back on dining out, impulsive online shopping, or expensive subscriptions if your budget is tight.

Use the 50/30/20 Rule (Modified for Families)

The classic budgeting formula works well, but you might need to tweak it for family needs.

Suggested breakdown:

-

60% – Essentials (housing, food, utilities, education)

-

20% – Savings & debt repayment

-

20% – Leisure & personal expenses (entertainment, small treats)

Create a Monthly Meal Plan

Food is one of the biggest expenses for families.

Benefits of meal planning:

-

Reduces grocery waste

-

Prevents expensive last-minute takeout

-

Helps you buy in bulk for savings

Extra tip: Plan for a few budget-friendly meals each week like lentils, pasta, or rice-based dishes.

Build an Emergency Fund

Even small contributions can grow into a safety net.

Target: 3–6 months of essential expenses.

-

Start by saving 5–10% of income monthly, even if it’s small.

-

Keep this fund separate from your main bank account to avoid dipping into it.

Plan for School & Seasonal Expenses

School supplies, uniforms, and seasonal celebrations can catch you off guard.

How to prepare:

-

Save a little each month for these predictable costs.

-

Look for discounts during sales instead of buying last-minute.

Monitor and Adjust Every Month

Family needs change—so should your budget.

Review:

-

What categories went over budget?

-

Can you cut or reallocate funds?

-

Did you meet your savings goal?

Use Budget-Friendly Family Fun Ideas

Entertainment doesn’t need to be expensive.

-

Free community events

-

Family game nights

-

Picnics in the park

-

Library movie rentals

Sample Monthly Budget Plan for a Family on a $2,000 Income

| Category | % of Income | Amount |

|---|---|---|

| Housing & Utilities | 35% | $700 |

| Groceries & Household | 25% | $500 |

| Transportation | 10% | $200 |

| Savings & Emergency Fund | 15% | $300 |

| Debt Repayment | 5% | $100 |

| Leisure & Miscellaneous | 10% | $200 |

Key Takeaway:

With clear priorities, small consistent savings, and monthly reviews, families can thrive financially—even on a tight budget.

If you want, I can make a printable monthly family finance tracker so you can stick this plan on the fridge and update it easily each month. That way, the whole family stays on track.

ChatGPT said:

Got it — you want “Monthly Finance Plans for Families on a Budget” to be longer, more detailed, and packed with actionable information so it feels like a full, practical guide.

Here’s a lengthy, well-structured, and highly informative version:

Monthly Finance Plans for Families on a Budget

For many families, managing money is like walking a tightrope—you have to balance paying for essentials, preparing for the future, and enjoying life, all without falling into debt. The good news? You don’t need a massive income to have financial stability.

A monthly finance plan helps you take control, stretch your money further, and make sure every rupee (or dollar) is working for your family.

Start with a Clear Financial Picture

You can’t improve what you don’t measure. The first step is understanding exactly where your money comes from and where it’s going.

How to Do It:

-

List All Income Sources – Salary, side hustles, child benefits, pensions, or any irregular earnings.

-

Track Your Expenses – Keep receipts for at least a month or use a budgeting app.

-

Separate Fixed & Variable Costs:

-

Fixed: Rent/mortgage, insurance, school fees.

-

Variable: Groceries, utilities, entertainment.

-

Pro Tip: Use the last 3–6 months of bank statements to find hidden spending habits you might miss.

Set Realistic Monthly Financial Goals

If you don’t know what you’re working toward, you’ll never feel in control.

Examples of goals:

-

Pay off $200 of debt each month

-

Save $150 for emergencies

-

Spend only $400 on groceries

SMART Goal Formula:

-

Specific: “Save for my child’s school books.”

-

Measurable: “Put aside $50 monthly.”

-

Achievable: Fits within your budget.

-

Relevant: Supports your family’s needs.

-

Time-bound: “Reach $300 by 6 months.”

Create a Family Budget Using the 60/20/20 Rule (Adjusted for Tight Budgets)

While the 50/30/20 budgeting rule is popular, families with limited income might need adjustments.

Suggested breakdown:

-

60% Essentials: Housing, utilities, groceries, education, transportation.

-

20% Savings & Debt Repayment: Emergency fund, retirement, loan payments.

-

20% Discretionary Spending: Entertainment, hobbies, eating out.

If money is really tight, shift to 70/20/10 to give more room for essentials.

Master the Grocery Budget

Food is one of the top expenses for families—and one of the easiest to control.

Tips for Savings:

-

Plan meals for the week to avoid last-minute takeout.

-

Buy in bulk for staples like rice, flour, and cooking oil.

-

Shop store brands instead of name brands.

-

Use cashback apps or discount coupons.

-

Batch cook and freeze meals to reduce waste.

Example: If you spend $600 monthly on groceries, cutting 10% saves $720 a year.

Build & Protect Your Emergency Fund

An emergency fund is your family’s safety net when life throws unexpected bills your way—like medical expenses, car repairs, or sudden job loss.

Steps to Build It:

-

Open a separate savings account (so you don’t spend it accidentally).

-

Automate transfers each month (even if it’s just $25–$50).

-

Aim for 3–6 months of essential expenses over time.

Reduce & Eliminate Unnecessary Expenses

You might be surprised how much you spend on things you don’t truly need.

Cutting Ideas:

-

Cancel unused subscriptions (streaming, magazines, gym).

-

Reduce dining out from twice a week to once a month.

-

Switch to prepaid phone plans.

-

Use public transport or carpool.

Small cuts in multiple areas can save hundreds monthly.

Plan for Annual & Seasonal Costs in Advance

School fees, holidays, and home repairs often catch families off guard. Instead of scrambling for money, plan ahead.

How to Do It:

-

List yearly expenses (birthdays, school uniforms, holidays, insurance renewals).

-

Divide by 12 and save that amount monthly.

-

Use a separate “Seasonal Savings” account or labeled envelope.

Involve the Whole Family

Money management works best when everyone is on the same page.

For Kids:

-

Teach them to save part of their pocket money.

-

Give them small budgeting tasks, like comparing grocery prices.

For Adults:

-

Hold monthly “budget meetings.”

-

Share updates on goals (debt paid, savings grown).

Use the Envelope Method for Cash Control

This is a powerful old-school method for families who overspend.

How It Works:

-

Withdraw cash for key spending categories (groceries, transport, entertainment).

-

Put the money into labeled envelopes.

-

Spend only what’s in the envelope—no dipping into other funds.

Review & Adjust Every Month

Life changes—your budget should too.

End-of-Month Checklist:

-

Did we meet our savings goal?

-

Which category went over budget?

-

Can we cut or reallocate funds?

This process keeps your plan realistic and effective.